February 4, 2026 – SpaceX announced the acquisition of xAI on February 2, 2026, through a blog post on SpaceX’s website signed by Elon Musk. The transaction combines two companies under Musk’s control into what is reported to be the largest private company merger in history. This document provides a comprehensive factual overview of the announced transaction based on official statements and reported details.

Announcement Details

Date: February 2, 2026

Announcement Method: Blog post published on SpaceX’s website

Announcement Author: Elon Musk

Initial Media Report: Bloomberg News first reported the completed deal on February 2, 2026

Official Confirmation: xAI confirmed the acquisition on its website (x.ai) on February 2, 2026

Transaction Structure

Valuation

Combined Entity Valuation: $1.25 trillion (reported by Bloomberg and confirmed by CNBC citing documents)

SpaceX Standalone Valuation:

- Range: $859 billion to $1.26 trillion (per bank valuation documents viewed by CNBC)

- Transaction value: $1 trillion (per CNBC reporting from documents)

- Most recent secondary share sale valuation (December 2025): $800 billion

xAI Standalone Valuation:

- Range: $219 billion to $294 billion (per bank valuation documents)

- Transaction value: $250 billion (per CNBC reporting from documents)

- Most recent funding round valuation (January 2026): $230 billion

Share Exchange Structure

Exchange Ratio: 1 share of xAI converts to 0.1433 shares of SpaceX stock

Share Pricing (per documents viewed by CNBC):

- xAI: $75.46 per share

- SpaceX: $526.59 per share

Transaction Type: Share exchange (merger)

Companies Involved

SpaceX

Founded: 2002

Founder: Elon Musk

Primary Operations:

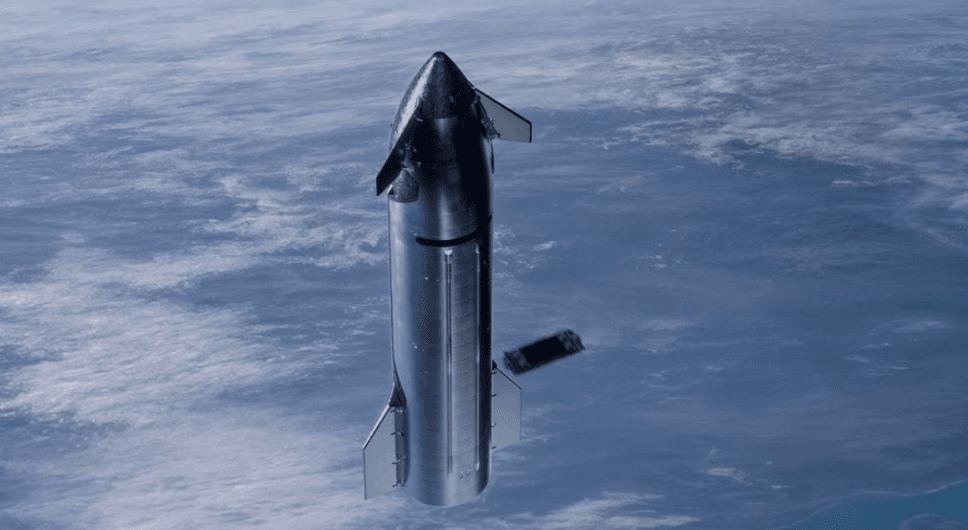

- Orbital launch services

- Starlink satellite internet service

- Starship rocket development

Recent Performance (per Reuters, citing two people familiar with results):

- 2025 Revenue: $15-16 billion

- 2025 Profit: $8 billion (estimated)

Starlink Statistics:

- Satellites in orbit: More than 9,000

- Customers: Approximately 9 million

Revenue Composition: Approximately 80% of revenue comes from launching its own Starlink satellites (per Reuters)

Government Contracts: SpaceX holds tens of billions of dollars worth of federal government contracts, including contracts with NASA and the Department of Defense

xAI

Founded: 2023

Founder: Elon Musk

Primary Operations:

- Grok AI chatbot and platform

- AI model development

- X social media platform (merged with xAI in 2025)

Recent Funding:

- January 2026: Closed $20 billion funding round at $230 billion valuation

Investors in Recent Funding Round:

- Nvidia

- Cisco Investments

- Valor Equity Partners

- Stepstone Group

- Fidelity

- Qatar Investment Authority

- Abu Dhabi’s MGX

- Baron Capital Group

Recent Investments Received:

- Tesla: $2 billion (announced late January 2026)

- SpaceX: $2 billion (prior to merger)

Financial Performance:

- Monthly cash burn: Approximately $1 billion (per Bloomberg)

Prior Merger: xAI acquired X (formerly Twitter) in 2025, with combined valuation stated as $113 billion

Stated Rationale for Merger

From Musk’s Announcement

Musk’s blog post announcing the acquisition stated:

“Current advances in AI are dependent on large terrestrial data centers, which require immense amounts of power and cooling. Global electricity demand for AI simply cannot be met with terrestrial solutions, even in the near term, without imposing hardship on communities and the environment.”

Musk described the combined entity as: “the most ambitious, vertically-integrated innovation engine on (and off) Earth, with AI, rockets, space-based internet, direct-to-mobile device communications and the world’s foremost real-time information and free speech platform.”

The announcement stated: “This marks not just the next chapter, but the next book in SpaceX and xAI’s mission: scaling to make a sentient sun to understand the Universe and extend the light of consciousness to the stars!”

Orbital Data Centers

Musk stated that a main reason for the merger was to build “orbital data centers.”

Musk wrote: “My estimate is that within 2 to 3 years, the lowest cost way to generate AI compute will be in space.”

FCC Filing: SpaceX filed with the Federal Communications Commission in the week prior to the announcement for authorization to launch AI satellites for orbital data centers

Stated Plan: A constellation of up to one million AI satellites utilizing solar power in space to run AI compute

Planned Initial Public Offering

IPO Timeline and Size

Expected Timing: 2026 (specific date not announced)

Previously Reported Timeline: As early as June 2026 (per earlier reports before merger announcement)

Expected Capital Raise: Up to $50 billion (per Financial Times, cited in multiple reports)

Expected IPO Valuation:

- As high as $1.5 trillion (per Financial Times)

- $1.25 trillion (per Bloomberg and other sources citing the merger valuation)

Impact of Merger on IPO: Unclear whether the merger affects the previously reported June 2026 timeline

What IPO Would Include

The IPO would cover the combined SpaceX-xAI entity, including:

- SpaceX rocket and launch operations

- Starlink satellite internet service

- xAI artificial intelligence operations

- X social media platform

- Orbital data center initiatives

Not Included: Tesla, The Boring Company, and Neuralink remain separate entities

Musk’s Ownership Stakes

Tesla: Approximately 18% equity ownership (per Electrek)

SpaceX: Approximately 42% equity ownership with 79% voting control (per Electrek)

xAI: Controlling stake (specific percentage not publicly disclosed)

Prior Interconnections Between Companies

Personnel Overlap

Christopher Stanley serves as:

- Principal security engineer for SpaceX (since 2018)

- Senior director of security engineering for X (since 2022)

Multiple employees worked at both SpaceX and xAI prior to the merger, though specific numbers were not disclosed.

Financial Interconnections

Tesla Investment in xAI: $2 billion announced in late January 2026

SpaceX Investment in xAI: $2 billion prior to merger announcement

Result of Merger: Tesla’s $2 billion investment in xAI becomes an indirect stake in the combined SpaceX-xAI entity

Reported Motivations and Context

xAI Financial Situation

Cash Burn: Bloomberg reported xAI is currently burning approximately $1 billion per month

Competitive Position: xAI is competing with OpenAI, Google, and other established AI companies that were earlier to market

Infrastructure Costs: Building AI infrastructure to compete with established players requires substantial ongoing capital

SpaceX Revenue Concentration

Starlink Dependency: Approximately 80% of SpaceX revenue comes from launching its own Starlink satellites (per Reuters)

Orbital Data Center Revenue: The merger creates a new sustained revenue stream for SpaceX through launching satellites for orbital data centers

Access to Capital

The merger provides xAI with:

- Access to SpaceX’s profitable operations

- Path to public markets through SpaceX’s planned IPO

- Exit strategy for xAI investors

Regulatory Considerations

Regulatory Review Questions

Committee on Foreign Investment in the United States (CFIUS): Executives at SpaceX and xAI did not respond to requests for comment on whether the merger may require CFIUS review

Department of Defense Contracts: SpaceX holds tens of billions in federal contracts; regulatory implications of merger with xAI (which has different security clearances and oversight) remain unclear

Foreign Investment: xAI’s January 2026 funding round included Qatar Investment Authority and Abu Dhabi’s MGX; implications for SpaceX’s defense contracts require clarification

Existing Regulatory Issues

xAI Regulatory Probes: xAI is facing regulatory probes in multiple international jurisdictions following Grok AI tools enabling generation and sharing of:

- Sexualized images of children

- Non-consensual intimate images of adults, mostly women

Washington Post Reporting: Musk loosened restrictions on Grok chatbot, contributing to its use for generating problematic imagery

Department of Defense AI Usage

January 2026: The Department of Defense initiated use of Grok within the Pentagon

Scope: Information flowing through military intelligence databases can be analyzed using Grok, Google’s Gemini, and other AI systems

Timing: This DoD adoption occurred weeks before the merger announcement

Tesla Implications

Tesla Not Included in Merger

Initial speculation suggested a potential three-way combination including Tesla. This did not occur.

Structural Barriers:

- Tesla is publicly traded with independent shareholders

- Fiduciary complications exist in merging a public company into a private entity

- Public shareholder approval would be required

Tesla’s Position Post-Merger

Investment Status: Tesla’s $2 billion xAI investment announced in late January 2026 now represents an indirect stake in the combined SpaceX-xAI entity

Shareholder Implications: Tesla shareholders effectively own a small stake in SpaceX through the xAI investment

Existing Tesla-xAI Lawsuit

A lawsuit regarding Tesla’s $2 billion investment in xAI alleged breach of fiduciary duty, arguing that Musk was using Tesla’s balance sheet to benefit his private companies.

Status Post-Merger: The lawsuit concerns remain relevant and potentially become more complex with the merger structure

Comparative Scale

Largest Private Company Merger

Multiple sources described the transaction as the largest private company merger in history.

Valuation Comparison to Tesla

Tesla Market Capitalization: Not specified in merger announcements, but the combined SpaceX-xAI valuation approaches or potentially exceeds Tesla’s public market valuation

Employee and Cultural Considerations

Statement from Former xAI Staffer (Benjamin De Kraker, former human data team member):

“xAI prides itself on ‘move fast and break things,’ flat hierarchy, act first ask questions later. (It isn’t fully this, but tries to be) I have a hunch many xAI people will hit culture shock w/ SpaceX.”

This statement indicates potential cultural differences between the two organizations that may require integration management.

Timeline Summary

2002: SpaceX founded

2015: Musk co-founded OpenAI (left in 2018)

2023: Musk launched xAI

2025: xAI merged with X (formerly Twitter)

December 2025: SpaceX secondary share sale at $800 billion valuation

January 2026: xAI closed $20 billion funding round at $230 billion valuation

Late January 2026: Tesla announced $2 billion investment in xAI

Week of January 27, 2026: SpaceX filed with FCC for orbital data center satellite authorization

February 2, 2026: SpaceX acquisition of xAI announced

2026 (expected): Combined entity IPO planned

What Remains Unclear

As of February 3, 2026, the following aspects require clarification:

- Exact IPO timing: Whether merger affects previously reported June 2026 timeline

- Regulatory approvals: Whether CFIUS review or other regulatory clearances are required

- Shareholder approval: Whether any shareholder votes are necessary for completion

- Employee integration: How the two workforces will be combined

- Operational structure: How SpaceX and xAI operations will be managed post-merger

- Government contract implications: How xAI’s addition affects SpaceX’s classified work

- Orbital data center timeline: Specific plans and timelines for space-based AI infrastructure

- Financial terms beyond share exchange: Any cash components or earnouts

- Governance structure: Board composition and voting rights in combined entity

- Debt assumption: Whether SpaceX assumes any xAI obligations

Conclusion

The SpaceX acquisition of xAI, announced February 2, 2026, creates a combined entity valued at $1.25 trillion through a share exchange structure (1 xAI share = 0.1433 SpaceX shares). The transaction combines SpaceX (valued at $1 trillion) with xAI (valued at $250 billion) ahead of a planned 2026 IPO that could raise up to $50 billion.

The stated rationale focuses on building orbital data centers to address power and cooling constraints of terrestrial AI infrastructure. xAI gains access to SpaceX’s profitable operations and a path to public markets, while SpaceX gains a sustained revenue stream from launching orbital AI infrastructure.

Regulatory approvals, exact IPO timing, and operational integration details remain to be clarified. The transaction represents the largest private company merger by valuation and will be among the largest IPOs in history when completed.

This document provides factual information based on official announcements and media reports as of February 3, 2026. It does not include analysis or opinions regarding the transaction’s merits or strategic rationale.

Leave a Reply