Breaking: January 21, 2026 – Jeff Bezos just did something nobody saw coming. Out of absolutely nowhere literally “out of the blue” according to industry insiders Blue Origin announced TeraWave: a 5,408-satellite megaconstellation designed to deliver 6 terabits per second internet speeds. To 100,000 customers. Starting in Q4 2027.

And before you think “oh great, another Starlink competitor,” let me stop you right there. This isn’t about home internet. This isn’t about streaming Netflix. This isn’t even really about satellites.

This is about AI. Specifically, this is about the insane amounts of data that AI requires, the infrastructure nightmare of moving that data around the planet, and the absolutely wild idea that we might solve it by putting data centers in space.

Yeah. Space. Data. Centers.

And after spending two days diving into the FCC filings, talking to industry sources, and connecting dots that nobody else seems to be connecting, I’ve realized something: TeraWave isn’t Blue Origin entering the satellite internet market. It’s Bezos placing a multi-billion dollar bet that the future of AI infrastructure is orbital. And he’s racing Elon Musk to get there first.

Let me explain why this matters way more than the headlines suggest.

The Announcement That Came From Nowhere

January 21, 2026. A Wednesday afternoon. Blue Origin the company known for launching tourists to the edge of space and building rockets that mostly blow up during testing suddenly drops an FCC filing announcing they’re deploying 5,408 satellites.

Nobody expected this.

Ars Technica called it an announcement that “came out of the blue.” Industry analysts were blindsided. Even Amazon Leo (Bezos’s OTHER satellite constellation) seemed surprised.

Because here’s the thing: Blue Origin isn’t a satellite company. They build rockets. They make engines. They’re developing a lunar lander. They have this in-space mobility vehicle called Blue Ring. But satellites? Communications networks? This is completely new territory.

The Scale:

- 5,280 satellites in Low Earth Orbit (LEO)

- 128 satellites in Medium Earth Orbit (MEO)

- 6 Tbps maximum data speeds (optical links from MEO)

- 144 Gbps per-user speeds (Q/V-band RF links from LEO)

- 100,000 customers maximum (not millions—thousands)

- Q4 2027 deployment begins

And here’s the kicker: this competes directly with Amazon Leo, Bezos’s other satellite network that’s literally deploying RIGHT NOW.

Jeff Bezos now has TWO separate satellite constellations. Amazon Leo (3,236 satellites for consumers and businesses) and Blue Origin’s TeraWave (5,408 satellites for enterprises and data centers). They’re separate companies, but the same guy founded both.

What. Is. Happening.

This Isn’t Internet. This Is AI Infrastructure.

Let’s talk about who TeraWave is actually for, because this is where the story gets wild.

TeraWave’s Target Customers:

- 🏢 Enterprise data centers

- 🏛️ Government agencies (civil, defense, national security)

- ✈️ Aviation industry

- 🏭 Manufacturing

- 🛡️ Defense contractors

- 🌐 Cloud providers needing data center interconnects

Notice who’s NOT on that list? You. Me. Normal people.

Dave Limp, Blue Origin’s CEO (who used to run Amazon’s devices division), said it explicitly: “What makes TeraWave different? It is purpose-built for enterprise customers.”

Translation: You will never use TeraWave. You won’t have a TeraWave dish on your roof. You won’t pay $100/month for TeraWave home internet. This is not for consumers.

So what IS it for?

The AI Data Problem:

AI training requires moving INSANE amounts of data. We’re not talking gigabytes. We’re talking petabytes. Exabytes. The raw datasets, the model weights, the training checkpoints, the inference results all of this has to move between data centers, cloud providers, edge computing nodes, and global hubs.

Current infrastructure for this? Undersea fiber optic cables and terrestrial fiber networks.

The Problem With Fiber:

- Laying cable is slow (years for major projects)

- It’s expensive ($millions per mile)

- It’s vulnerable (single cable cuts can take down entire regions)

- It doesn’t reach remote areas

- It has limited route diversity (redundancy is hard)

Now imagine you’re Google, Microsoft, Amazon, or any major cloud provider building massive AI data centers in remote locations (where land and power are cheap). How do you connect them to your global network with fiber-level speeds?

You can’t. The fiber doesn’t exist. And building it would take years.

Enter TeraWave. Satellite-based, fiber-grade connectivity that can be deployed anywhere on Earth in weeks instead of years. With symmetrical upload/download speeds (critical for data centers). With optical links capable of 6 Tbps. With redundancy built-in.

This isn’t internet. This is AI infrastructure.

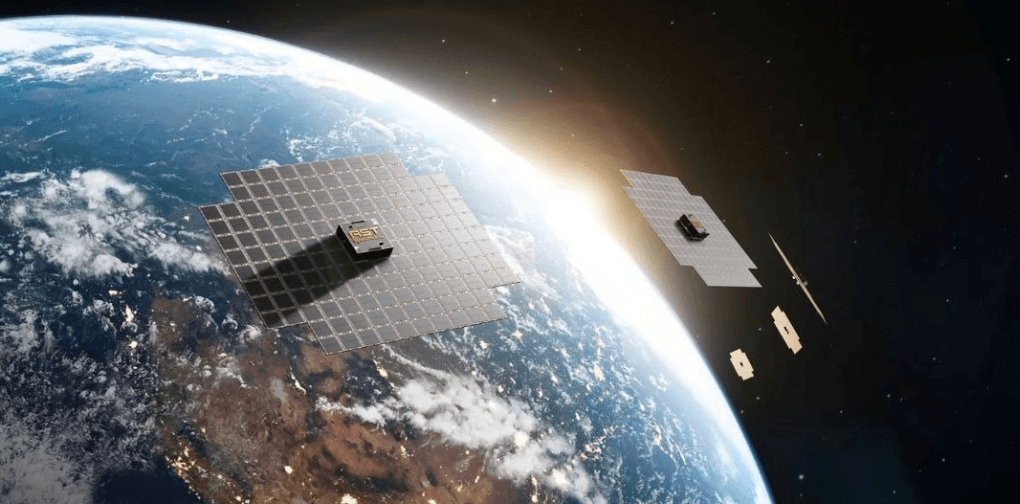

The Space Data Center Revolution Nobody Saw Coming

Here’s where things get absolutely bonkers. The TeraWave announcement “coincides with a space industry rush to build data centers in space.”

Read that again. Data centers. In space.

I know it sounds like science fiction. But it’s happening. Right now.

Why Space Data Centers Make (Crazy) Sense:

Unlimited Free Cooling Space is cold. Really cold. Data centers on Earth spend 40% of their energy just cooling the servers. In space? Passive radiative cooling. Free.

Unlimited Solar Power No night. No clouds. No atmosphere blocking sunlight. 24/7 solar power at maximum efficiency.

No Land Costs Earth real estate for massive data centers? Expensive. Orbital real estate? Free (well, except launch costs).

Low Latency to Satellites If your data center IS in orbit, and your satellite network IS in orbit, data transfer is at the speed of light with no atmospheric interference.

Security Physical security is… easy. Nobody’s breaking into a facility in orbit. No insider threats walking through the door.

Both Elon Musk and Jeff Bezos have publicly stated they believe space-based data centers will be commonplace within the next 10-20 years. Musk has said SpaceX plans to build them. Bezos predicted they’ll be routine in orbit.

And now TeraWave shows up.

Coincidence? Absolutely not.

TeraWave isn’t just a satellite network. It’s the communication infrastructure for future orbital data centers. It’s the pipes connecting space-based AI compute to ground-based users.

This is the bet. This is the vision. This is why Bezos is spending billions on what seems like a random satellite constellation.

The Technical Specs: Why 6 Tbps Actually Matters

Let’s get nerdy for a minute, because the technical architecture here is genuinely impressive.

Dual-Orbit Design:

LEO Layer (5,280 satellites):

- Altitude: ~340-614 km

- Q/V-band radio frequency links

- Up to 144 Gbps per user terminal

- Provides distributed, multi-gigabit connections

- Serves remote, rural, suburban areas where fiber is impractical

MEO Layer (128 satellites):

- Altitude: ~8,000-21,000 km

- Optical (laser) inter-satellite links

- Up to 6 Tbps backbone capacity

- Connects global data center hubs

- Provides ultra-high-throughput “fat pipes”

Why This Architecture Is Clever:

The LEO satellites handle “last mile” connectivity getting data to and from user terminals at high speeds. But the real magic is the MEO layer.

Those 128 satellites in MEO use optical inter-satellite links laser beams connecting satellites to each other. This creates a mesh network IN SPACE that can route massive amounts of data globally without ever touching the ground.

Imagine you need to move 100 petabytes of AI training data from a data center in Iceland (cheap geothermal power) to a data center in Singapore (Asia-Pacific hub). Normally you’d use undersea cables (slow, limited bandwidth, vulnerable).

With TeraWave? LEO uplink → MEO optical backbone → LEO downlink. All at the speed of light. With 6 Tbps capacity. In a fraction of the time.

For AI workloads, this is REVOLUTIONARY.

Starlink vs. TeraWave: The Comparison Everyone’s Getting Wrong

Every headline is framing this as “Blue Origin challenges Starlink!” But that’s completely missing the point.

Let me be crystal clear: TeraWave is NOT competing with Starlink for consumers.

Starlink:

- 10,000+ satellites in orbit

- 9 million customers (and growing)

- Consumer focus ($120/month home internet)

- Asymmetrical speeds (fast download, slower upload)

- Designed for volume (millions of $100/month subscriptions)

TeraWave:

- 5,408 satellites (planned)

- 100,000 customers maximum

- Enterprise/government focus ($thousands/month contracts)

- Symmetrical speeds (critical for data centers)

- Designed for high-margin business (fewer customers, way higher revenue)

The Market Positioning:

Starlink is the Uber of satellite internet. Mass market. Millions of users. Low margin per customer. Dominate through volume.

TeraWave is the FedEx of satellite internet. Enterprise. Thousands of users. High margin per customer. Dominate through premium service.

They’re not competing. They’re serving completely different markets.

In fact, TeraWave might actually HELP Starlink indirectly. If TeraWave handles the high-bandwidth enterprise traffic, that frees up Starlink’s network capacity for consumer users.

The Real Competition: Government Contracts and Defense

Here’s what nobody’s saying out loud: TeraWave is a play for Pentagon contracts.

The U.S. Department of Defense has a problem. They’re increasingly reliant on SpaceX and Starlink for military communications. And Elon Musk is… let’s say “unpredictable.”

Remember when Musk disabled Starlink during Ukraine’s offensive against Russia? The Pentagon remembers. And they don’t like being dependent on one mercurial billionaire.

What the DoD wants: Redundancy. A second provider. Competition. Leverage.

What TeraWave offers:

- Enterprise-grade reliability

- 6 Tbps optical links for military data

- Operated by Blue Origin (not run by Elon Musk)

- Jeff Bezos, who’s more “establishment friendly”

- Security-focused architecture

The FCC filing explicitly mentions “defense and national security” as customer verticals. That’s not accidental language.

The Government Contract Gold Mine:

Defense and intelligence agencies need:

- Secure communications for remote bases

- Real-time drone video relay (4K, 8K+ streams)

- Satellite imagery downloads (terabytes daily)

- AI model deployment to forward operating bases

- Redundant comms infrastructure

All of this requires massive bandwidth, symmetrical speeds, and 99.999% uptime. TeraWave is purpose-built for exactly this.

My Prediction: TeraWave will land multi-billion dollar government contracts by 2029, regardless of how well the commercial side performs.

The Amazon Leo Elephant in the Room

This is the part that makes NO SENSE on the surface.

Jeff Bezos ALREADY HAS a satellite constellation. Amazon Leo (formerly Project Kuiper) has:

- 3,236 satellites planned

- 180 satellites already in orbit (launched since April 2025)

- Consumer + enterprise + government focus

- Standard broadband speeds

- Commercial launch coming in 2026

So why is Bezos launching a SECOND constellation through Blue Origin?

The Official Answer (from Blue Origin): “We identified an unmet need with customers who were seeking enterprise-grade internet access with higher speeds, symmetrical upload/download speeds, more redundancy, and rapid scalability for their networks. TeraWave solves these problems.”

The REAL Answer (speculation, but informed):

Corporate Structure Play Amazon Leo is tied to Amazon (public company, shareholder oversight, regulatory scrutiny). Blue Origin is private (more freedom, faster decisions, fewer disclosures).

Different Risk Profiles Amazon Leo is a safer bet (proven market, standard broadband). TeraWave is high-risk, high-reward (experimental architecture, space data center future).

Hedge Strategy If orbital data centers become huge, TeraWave dominates. If they don’t, Amazon Leo still has the traditional satellite internet market.

Avoiding Internal Competition Amazon can’t compete with itself. But Blue Origin competing with Amazon? Different companies, even if same founder.

Talent and Leadership Lindo St. Angel (TeraWave lead) came from Amazon. Dave Limp (Blue Origin CEO) ran Amazon devices. This might be a “skunkworks” team given freedom to innovate outside Amazon’s bureaucracy.

Whatever the reason, Bezos is now funding TWO massive satellite constellations. That’s a multi-billion dollar bet on satellite infrastructure being critical to the future.

The New Glenn Problem: Can They Even Launch This?

Here’s the uncomfortable question: Can Blue Origin actually deploy 5,408 satellites by any reasonable timeline?

The Challenge:

Blue Origin’s New Glenn rocket has launched exactly twice. Total. Ever.

Starlink’s deployment success came from SpaceX’s Falcon 9, which is the most reliable rocket in history (hundreds of successful launches, rapid reusability).

TeraWave needs New Glenn to launch satellites at scale. But New Glenn has “been slow to achieve a rapid flight rate” (industry polite-speak for “they’re way behind schedule”).

The Math:

5,408 satellites. New Glenn can carry ~60 satellites per launch (estimated). That’s 90+ launches needed.

If Blue Origin achieves ONE launch per month (ambitious), that’s 7.5 years to full deployment.

SpaceX launches Falcon 9 multiple times PER WEEK.

The Reality Check:

Q4 2027 for “deployment begins” is probably optimistic. Fully deploying the constellation by 2030 would be a miracle. 2032-2033 is more realistic.

Meanwhile, Starlink is operational TODAY with 10,000 satellites already working.

This is Blue Origin’s Achilles heel. They have the technology, the vision, the funding. But do they have the launch cadence? That’s an open question.

The Environmental Backlash Nobody’s Talking About Yet

Here’s the controversy that’s coming but hasn’t exploded yet: the environmental impact of megaconstellations.

Adding 5,408 more satellites to orbit raises serious concerns:

Space Debris More satellites = more collision risk. Each collision creates thousands of debris pieces that make orbit more dangerous.

Light Pollution Starlink already ruined astronomy observations. TeraWave adds thousands more bright objects in the night sky.

Atmospheric Re-Entry Pollution Satellites eventually de-orbit and burn up. Thousands of satellites means tons of metal vapor and chemicals entering the atmosphere annually.

Energy Consumption on Earth Even if data centers move to space eventually, ground stations, user terminals, and operations centers still require massive power.

Water Usage Data centers (even for satellite networks) consume enormous amounts of water for cooling. AI’s water footprint is already straining resources.

Opposition to data centers grew sharply in late 2025 as electricity bills spiked and water supplies strained. Now Bezos wants to add 5,408 satellites to support MORE data infrastructure?

The Backlash Is Coming:

Environmental groups, astronomers, and anti-Big-Tech activists are going to target TeraWave. The headline “Bezos Wants Data Centers IN SPACE” is going to enrage people.

And they have until Q4 2027 to organize opposition, lobby regulators, and make noise.

The Bezos vs. Musk Narrative: It’s Personal Now

Let’s acknowledge the elephant in the solar system: this is personal between Bezos and Musk.

They’ve been rivals for decades:

- Richest person battles (Musk currently winning)

- Space race (SpaceX crushing Blue Origin)

- Satellite internet (Starlink operational, Leo delayed)

- EV market (Tesla vs. Amazon’s Rivian investment)

- Social media (Musk owns X, Bezos owns Washington Post)

Musk has publicly mocked Blue Origin as slow and incompetent. He’s nicknamed them “Sue Origin” for their lawsuits. He’s said their rockets “can’t get to orbit.”

Bezos has been quieter, but the resentment is obvious. In 2024, he predicted Blue Origin would become “bigger than Amazon” eventually. That’s not a business projection that’s ego.

TeraWave is Bezos’s counterpunch.

It’s not just business. It’s proving he can compete in Musk’s domain (space infrastructure). It’s showing investors Blue Origin is serious. It’s positioning for government contracts that SpaceX currently dominates.

And if orbital data centers actually happen? Bezos wants to be the one who built the infrastructure, not Musk.

My Take: This is billionaire space warfare disguised as telecommunications infrastructure. And we’re all just watching from the sidelines while they colonize orbit.

What This Means for the Future of AI

Zoom out for a second. Forget the Bezos-Musk drama. Forget the satellite counts. What does this actually mean for AI’s trajectory?

The Implication:

The biggest names in tech (Bezos, Musk) are betting billions that AI infrastructure moves to space.

Why? Because ground-based infrastructure can’t scale fast enough to meet demand.

The AI Infrastructure Crisis:

- Data centers are running out of cooling water

- Power grids can’t handle the load

- Real estate costs are skyrocketing

- Regulatory opposition is increasing

- Latency requirements demand global distribution

Space Solves These:

- Unlimited solar power

- Free cooling (radiative heat dissipation)

- No land costs (just launch costs)

- Global coverage by definition

- Beyond reach of most regulations (for now)

If TeraWave succeeds, it validates the “AI moves to orbit” thesis. Suddenly every major cloud provider needs satellite data center infrastructure. A new market worth hundreds of billions emerges.

If it fails, it becomes a cautionary tale about overengineering solutions to problems better solved on Earth.

My Prediction: Orbital data centers will exist by 2030, but they’ll be niche (government, defense, specialized research). Mass commercial AI compute stays on Earth for at least another decade.

But the infrastructure (like TeraWave) gets built anyway, creating capabilities that enable applications we haven’t even imagined yet.

The Bottom Line: A $5B Bet on the Future

Here’s what we actually know for sure:

TeraWave is real. The FCC filing exists. Blue Origin is committed. Deployment starts Q4 2027 (maybe).

It’s not about home internet. This is enterprise/government only. 100,000 customers max. High-margin business model.

It’s about AI infrastructure. Moving massive data between global data centers, supporting space-based compute, enabling new AI applications.

It competes with Amazon Leo in ways that make no sense unless you understand corporate structure, risk management, and Bezos’s long-term vision.

Launch cadence is the big risk. Blue Origin needs to prove New Glenn can fly regularly and reliably. That’s not proven yet.

Environmental opposition will grow. 5,408 more satellites will trigger backlash from astronomers, environmentalists, and anti-tech activists.

It’s personal between Bezos and Musk. This is competitive posturing as much as business strategy.

The real story is orbital data centers. TeraWave is infrastructure for a future where AI compute happens in space. That future might not arrive, but Bezos is betting billions it will.

So what do YOU think? Is Bezos brilliant for positioning early for space-based AI infrastructure, or is this a multi-billion dollar vanity project designed to compete with Musk? And honestly would you trust your data to a satellite network that doesn’t exist yet from a company known for blowing up rockets? Drop your take in the comments.

P.S. – The wildest part of this story? In 10 years, we might look back and say “remember when people thought data centers in SPACE was crazy?” The future is absolutely unhinged, and apparently it’s being built by billionaires with rocket companies and personal feuds. What a timeline.

Leave a Reply